Retail Banking

Kasikornbank's earnings down 12% to US$269m in Q2

Blame it on the 16% increase in provisioning expenses.

Kasikornbank's earnings down 12% to US$269m in Q2

Blame it on the 16% increase in provisioning expenses.

Public Bank's profit up 6% to US$310m in Q2

This brings the bank's profit to US$602m in the first half of 2017.

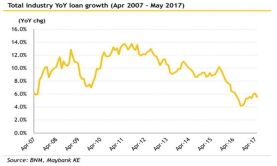

Chart of the Week: Check out Malaysian banks' loan growth in the past 10 years

Industry loan growth stands at 2.8% on an annualised basis.

Australian banking sector to come under review

It will be lead by King & Wood Mallesons partner Scott Farrell.

China banks' assets up 11.4% to $35.04t as of end-June

Liabilities also rose 11.3%.

Singapore: 1 in 5 customers want to ditch their main bank

They hate the long waiting time for just a single transaction.

DBS at risk of 10.8% profit drop in Q2

Analysts think receding fees would be the likely cause.

Why Siam Commercial Bank's NPL situation is better than its peers'

Only SMEs saw NPLs rose to 7.2% in Q2.

Bangkok Bank's provisioning expenses up 60% to US$342m

Credit cost is expected to remain elevated.

Higher SIBOR to spur growth in Singapore banks' interest income

At the end of June, 3-month SIBOR has risen to 1.115%.

China commits to tighten financial regulatory oversight

The current fragmented framework makes it more difficult for regulators to monitor banks.

PayCommerce's Abdul Naushad to discuss the evolution in the payments space

He will talk about the next generation in global transaction banking at the 2017 Banking Forum.

BOCOM International's Hao Hong to be one of the panelists at the 2017 Banking Forum

He will join the discussion about banks and fintechs.

Weekly Global News Wrap Up: Bank merger boom set to begin; New accounting rules for banks to worsen crises

JPMorgan records most profitable year and Credit Suisse ends cost-cutting era.

Aussie banks face 100bps increase in Tier-1 capital

The aim is for them to be 'unquestionably strong'.

What could boost growth of the Malaysian Islamic banking sector?

The country has US$150b in Islamic financial assets.

OCBC enables QR code fund transfers

The service is available through PayNow.

Advertise

Advertise