Retail Banking

Indian banks remain 'moderately capitalised'

Overall Capital Adequacy Ratio stood at 13.74% as of March 2017.

Indian banks remain 'moderately capitalised'

Overall Capital Adequacy Ratio stood at 13.74% as of March 2017.

Why the property sector remains a key risk for Hong Kong banks

The prevalence of high-LTV second mortgages increases default risks for homebuyers.

DBS invests $20m to train employees to become digital bankers

The bank will launch a programme that comprises AI-powered learning.

Why analysts see UOB's selective lending strategy attractive

The bank remains disciplined in its pricing.

Malaysian banks' total system deposits growth slows to 3.5%

Government deposits contracted for the 12th consecutive month.

More unfavourable regulations to impact Thai banks

Policies may even target leasing companies as well.

Australian banks' compliance issues get exposed

Thanks to the recent money laundering crackdown.

Standard Chartered names Pedro Cardoso as global head, digital commerce

Standard Chartered announced that Pedro Cardoso has joined its Retail Banking team taking on the role of Global Head, Digital Commerce on 2 August...

Bank Rakyat Indonesia's profit up 10.5% to US$1b in 1H17

Thanks to micro, consumer, and SME lending.

Maybank loan-to-deposit ratio stands at 94.7% as of March 2017

The bank sought to clarify a Bloomberg report that said its LDR is 101%.

State Bank of India mired in asset quality woes

Sharp NIM compression, weak loan growth, and merger pains are to blame.

Siam Commercial Bank's FY17E earnings could be hurt by up to 25%

That is if PACE had completely drawn down the credit lines totaling US$481m.

This promising segment could prove lucrative for Australian banks

That is if banks can tailor a unique package of services for their needs.

Weekly Global News Wrap Up: Big banks beset by a US$340b bill for poor conduct; Bitcoin's unprecedented growth spur crypto-bubble fears

RBS to cut 880 IT jobs and Goldman Sachs to use personality tests in hiring.

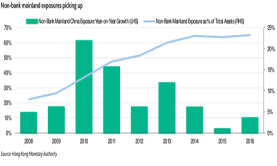

Chart of the Week: Hong Kong banks' mainland exposures to pick up in the next two years

That is following a period of steady decline starting in 2014.

Two ways for Australian banks to achieve 'unquestionably strong' capital ratios

Both methods are likely to be negative for shareholders.

Malaysian banks' gross impaired loans ratio improved to 1.64%

Loan loss coverage was stable MoM at 83.2%.

Advertise

Advertise