Southeast Asia

Indonesia, Malaysia, Thailand ink MOU for cross border bilateral transactions

The new framework is expected to synergise with cross-border payment initiatives.

Indonesia, Malaysia, Thailand ink MOU for cross border bilateral transactions

The new framework is expected to synergise with cross-border payment initiatives.

QR payments seen to skyrocket by 2028 – Study

Its transaction volume is expected to reach 90 billion by 2028.

SEA payment transactions to climb $54t by 2027 – report

Vietnam and Indonesia will have the biggest share in payment transaction volume.

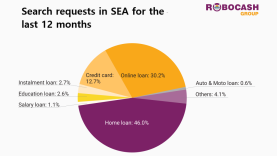

Housing loans, online loans most popular in SEA: study

Analysts said the rise in home loans is likely caused by the region’s geolocation.

E-wallet Nagad reaches 80 million account registers

This was in line with their journey of boosting the region’s SDGs.

SEA gains 8.1 million new fintech users in Q1: study

Fintech penetration in the region was estimated at 83.3%.

SEA’s interest in lending products increase 15%: Study

Total number of monthly requests is at 741.5k per month.

Islamic Development Bank, WHO start healthcare investment platform

The Islamic Development Bank is part of the collaboration where Malaysia and Indonesia are country members.

Nearly 9 in 10 SEA people now have access to credit

The report delves deeper into the effects of credit access on financial services provider (FSP) customers.

Citi Commercial Bank names head of corporate finance for ASEAN

Citi has also named a new country head for Citi Commercial Bank Malaysia.

OxPay and NomuPay ink partnership for market expansion

OxPay will be able to enter new markets where NomuPay already services.

UOB, Keppel to offer sustainable and digital solutions to SEA businesses

The primary objective of these solutions is to assist companies in their endeavours to achieve decarbonisation.

HSBC names new South Asia head of wealth and personal banking

Kai Zhan g will be responsible for expanding wealth management across South Asia.

Southeast Asia's cash in circulation to rise by 11.1% by 2027

Singapore is less cash-reliant compared to other markets in the region.

Macau Pass to provide acquiring services to SEA e-wallets

The Macau e-wallet can now accept GCash, Touch 'n Go e-Wallet and True Money.

Fuelling the future of finance with data streams

Traditional institutions need to utilise constant, real-time data flow that generates insights on the fly.

Zubin Rada Krishnan joins BigPay as group CEO

The company plans to launch in Thailand, Indonesia, and the Philippines within the year.

Advertise

Advertise