Lending & Credit

China's total social financing peaked in January at RMB2.5t: Barclays

Find out what other risks loom for China.

China gets tougher on shadow banking

New rules intend to slow explosive growth of the gray market.

Agricultural Bank of China reports record growth in loans to SMEs

Big Four bank said loans hit US$96 billion in 2012.

Nomura predicts strong micro credit growth recovery for Bank Rakyat Indonesia in FY13F

Thanks to the 6,000 newly-hired loan account officers.

This is how HKMA's tighter regulations help banks' credit profiles

The more severe 300bp interest-rate stress test is a boon after all.

Bangkok Bank to expand personal loan offering

Bangkok Bank is studying he best way to expand in the personal loans sector.

Bank lending to local government financing vehicles curbed

China urges local governments to abide by the rules to avert more bad loans.

Alibaba to finance Guangdong's small businesses

Alibaba will offer collateral-free credit loans to small business owners in Guangdong Province. It is building up its financing arm to tap its...

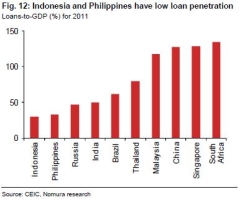

Loan penetration extremely low in ASEAN

Guess which country has the lowest loan penetration at 30% of GDP?

Loan growth in Malaysia to slow to 11% in 2013F

Rate of compression is likely to ease as well.

S.Korean banks told to support risky debtors

South Korea wants to prevent bank customers from becoming credit delinquents via a pre-workout program.

Philippine bank lending up 16.2%

Loan releases of Philippine commercial banks increased 16.2 percent to P3.219 trillion for the full year 2012.

Thailand's KTB, Exim Bank provide attractive SME loans

Krungthai Bank will increase its SME loans by Bt55 billion this year.

Bangkok Bank to benefit from Thailand's first-ever SME loan cycle since 1997

SME loans accounts for 90% of its loan book.

Chinese banks' medium- to long-term loans finally rebound after a 2-month decline

Loans were up RMB309.8b in January.

Why we can't expect much from Bank Rakyat Indonesia's net interest income growth until 2014

Awaiting the delayed effect of BRI's 2011 revitalization programme.

Advertise

Advertise